"Personal Finance 101: The Only 3 Money Skills for Teens You Need to Know to Get Rich" by Christian Pérez cuts through the noise of generic financial advice. This book provides actionable strategies for teens to build wealth, avoiding common pitfalls and developing crucial money skills. Instead of overwhelming readers with complex theories, Pérez delivers straightforward, effective techniques for budgeting, income generation (both active and passive), and wealth protection. Learn to identify hidden financial obstacles, restructure your money mindset, and leverage powerful strategies to achieve financial freedom early, building a secure financial future without years of trial and error. This isn't just another personal finance book; it's a practical guide to escaping the paycheck-to-paycheck cycle and building lasting wealth.

Review Personal Finance 101

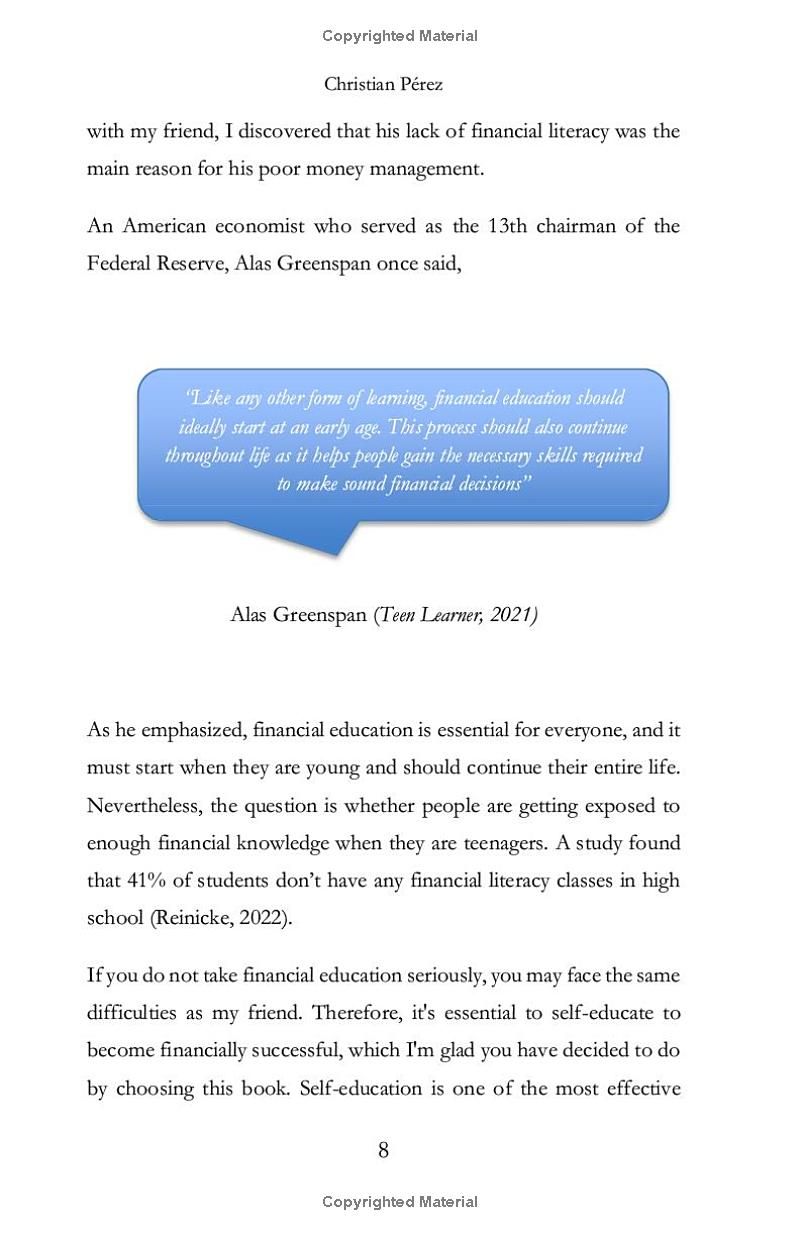

"Personal Finance 101: The Only 3 Money Skills for Teens You Need to Know to Get Rich" isn't your typical dry, dusty finance textbook. Instead, it feels like a friendly conversation with a genuinely helpful older sibling (or maybe a really cool financial mentor). Christian Pérez doesn't talk down to you; he recognizes that teens are capable of understanding complex concepts, but he also knows that information overload can be paralyzing. He skillfully navigates this balance, presenting crucial financial knowledge in a clear, engaging, and relatable way.

What I appreciated most is the book's focus on actionable steps. It's not just about theory; it provides concrete strategies that teens can immediately implement. The emphasis on building healthy financial habits from a young age is invaluable. So many books on personal finance get bogged down in complicated formulas and jargon, but this one cuts through the noise, focusing on the three core money skills that truly matter: budgeting, investing, and managing debt (or avoiding it altogether!).

The author cleverly addresses the psychological aspects of money management. He acknowledges that our beliefs and attitudes about money significantly impact our financial success. This is a crucial point often overlooked in other personal finance books. By helping teens restructure their money mindset, the book equips them not just with financial tools but also with the mental fortitude needed to achieve long-term financial well-being. This proactive approach sets it apart.

I particularly liked the way the book debunks common financial myths and misleading advice often perpetuated by "gurus." Instead of regurgitating tired clichés, Pérez offers real-world strategies based on his own experience and research. This authenticity shines through and makes the information more credible and trustworthy. The inclusion of personal anecdotes and relatable examples makes the learning process much more enjoyable and easier to digest.

While the title promises a path to riches, it's not about getting rich quick schemes. It's about building a solid financial foundation for a secure and fulfilling future. The book emphasizes the importance of long-term planning and sustainable wealth creation. It's a journey, not a sprint, and Pérez effectively conveys this message. Furthermore, the focus on both active and passive income streams provides teens with a diverse perspective on financial opportunities.

Overall, "Personal Finance 101" is a valuable resource for teens, regardless of their prior financial knowledge. It's a refreshing take on personal finance, making it accessible, engaging, and empowering. It's not just a book about money; it's a book about building confidence, taking control of your life, and securing your future. I highly recommend it to any teen wanting to gain financial literacy and build a bright financial future. It's an investment in their future that will pay significant dividends.

Information

- Dimensions: 5.5 x 0.54 x 8.5 inches

- Language: English

- Print length: 237

- Publication date: 2024

Preview Book